Cash back credit cards have become a favorite for people looking to earn rewards on everyday spending. Whether you’re buying groceries, fueling your car, or paying for utilities, these cards offer money back as a reward. But new users often have questions. How do they work? Are they worth it? Can they hurt your credit? This FAQ guide addresses the most common questions about cash back credit cards.

1. What Is a Cash Back Credit Card?

A cash back credit card is a card that returns a percentage of your purchases as cash. Unlike points or miles, cash back is straightforward: spend money, earn money back.

- Flat-rate cards: Offer the same percentage on all purchases, e.g., 1.5% cash back.

- Category-based cards: Offer higher rewards for specific spending categories, e.g., 3% on groceries, 2% on gas.

- Rotating category cards: Bonus categories change periodically, such as quarterly 5% cash back on different categories.

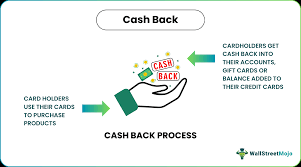

2. How Do Cash Back Rewards Work?

Rewards are typically credited in one of the following ways:

- Statement credit, reducing your balance

- Direct deposit to a bank account

- Gift cards (less common)

The percentage you earn varies by card and category. Always read the terms carefully, as some cards have spending caps for bonus categories.

3. Can Cash Back Expire?

Yes, some cards set expiration dates on cash back rewards, especially if the account is inactive. To avoid losing rewards:

- Use your card regularly

- Redeem rewards periodically

- Monitor your account online

Many modern cards now have no expiration, but it’s always best to confirm.

4. Are There Fees for Cash Back Credit Cards?

Some cards have:

- Annual fees: Some high-reward cards charge fees, but they are often offset by rewards if used wisely.

- Foreign transaction fees: Standard cards may charge 1–3% when used abroad.

- Late payment fees: Missing a payment can trigger fees and reduce or cancel earned rewards.

Choosing a card with no fees or rewards that exceed fees maximizes benefits.

5. Do Cash Back Cards Affect Your Credit Score?

Yes, but only through responsible or irresponsible use.

- Positive effects: Paying balances on time, keeping low utilization, maintaining long-term accounts.

- Negative effects: High balances, late payments, or opening multiple cards in a short period.

Cash back itself does not directly increase your credit score—it’s how you use the card that matters.

6. Can I Earn Cash Back on All Purchases?

Not necessarily. Most cash back cards have:

- Categories with higher percentages

- A base percentage on all other purchases

- Occasionally exclusions like cash advances or balance transfers

Read the fine print to understand which purchases earn rewards.

7. How Do Sign-Up Bonuses Work?

Many cash back cards offer bonuses for new users, such as:

- $200–$500 after spending a certain amount in the first 3 months

- Often combined with introductory 0% APR periods

Sign-up bonuses can accelerate reward earnings—but only if you spend normally to meet the requirement.

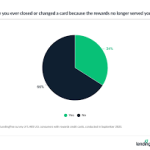

8. Can I Combine Cash Back Cards?

Yes, many users combine multiple cards to maximize rewards:

- One card for groceries

- Another for gas

- Base card for all other purchases

This strategy increases cash back but requires careful tracking to avoid missed payments.

9. Is It Worth It to Get a Cash Back Credit Card?

Cash back cards are worth it if:

- You pay your balance in full monthly

- You use categories strategically

- Rewards exceed any fees or costs

They are less useful for people who carry high balances, because interest charges can erase rewards.

10. How Do I Redeem My Cash Back?

Redemption methods vary:

- Statement credit: reduces your outstanding balance

- Direct deposit: money added to your bank account

- Gift cards or merchandise: sometimes available, but usually lower value

Statement credit is often the most flexible and straightforward option.

Final Thoughts

Cash back credit cards are one of the simplest and most practical ways to earn rewards while spending normally. Understanding fees, redemption methods, and category rules is essential for maximizing benefits.

Used responsibly, these cards can turn everyday expenses into tangible financial advantages—without extra effort or risk.

The bottom line: know your card, spend wisely, and let your money work for you.

Word Count:

594

Summary:

This article describes some frequently asked questions regarding cash back credit cards.

Keywords:

Cash Back Credit Card,Best Cash Back Credit Cards,Cash Back Credit Cards

Article Body:

It seems like a great idea to earn money while you spend it, isn’t it? But, is this possible or is it just a hoax? You can earn a lot of money with a cash back credit card. You can increment the percentage values of your income at the end of the year while using cash back credit cards. So use this article as a guide for choosing the best cash back credit cards.

FAQs for Cash Back Credit Cards

Here are some FAQs that may be of interest to you:

- How can I get the cash back?

You must be thinking that any purchases made though the cash back credit card would reap immediate financial benefits for you – but this is not the case exactly. Even the balanced transfers and the cash advances are not enough to get huge amounts of cash back. Don’t just take a credit card with cash back facility for the sole purpose of getting cash back. You might need to doubly confirm if you will get money back for all purchases or not. - What amount of cash do I receive on cash back?

If you use a credit card with cash back facility then you would definitely like to get the most bang for the buck. One should check and do a bit of research before zeroing into a particular credit card for the best cash back solution. Always check if the cash back offer by the credit card company is worth your while. - Can the cash back value be increased over the course of time?

It is often found with credit card companies that they encourage you to increase the overall balance on the card. But there are some companies that insist their customers get a larger cash back amount. If you work out these details before selecting a credit card company, the deal may prove to be beneficial for you. You can negotiate such details to your complete satisfaction before signing up for the card. - How can I get hold of my cash back amount?

A good cash back credit card should give you rewards as frequently as possible. There was a time where people had to wait for the 12th month to get the cash back but not so anymore. Some credit card companies allow their customers to redeem their cash back as payments against their balance or as soon a fixed amount is accrued. Others prefer to adjust the cash back amounts against the next year�s fees. - What fees should I pay?

You should find a credit card that prevents you from paying a sum to get your cash back. Make it sure that your credit card does not charge you a hefty amount, which upsets any rewards that you might receive in the future. As compared to the other credit cards, you would definitely like to have a credit card that returns better cash back. Check that it does not have any hidden fees with it. You have to make sure of this while applying for any of these credit cards with cash back facility. It should absolutely not ask for a large fee that may eat into your reward points.

One should not forget that a best cash back credit card helps you to find the best of services awarded to you. Choosing a better credit card out of the other existing cash back credit cards depends solely on your awareness levels and smarts. So go right ahead, select a cash back credit card that helps you achieve your financial goals.

Leave a Reply