For business owners, every expense matters. Business cash flow, budgeting, and cost management are everyday priorities. In this landscape, cash back business credit cards can serve as a valuable financial tool—offering rewards while helping manage spending.

Unlike personal cash back cards, business cash back cards are designed specifically for company expenses. They help businesses earn money back on everyday purchases, reward strategic spending, and optimize cash flow. But not all business cards are created equal. To make the most of these rewards, owners need to understand how they work, when they’re worth it, and how to avoid common pitfalls.

This article explains everything you need to know about cash back business credit cards—from the basics to choosing the right card for your business.

What Are Cash Back Business Credit Cards?

A cash back business credit card is a credit card issued to a company (or sole proprietor) that earns a percentage of cash back on qualifying purchases. Instead of earning points or miles, these cards return cash based on how much and where your business spends.

How Cash Back Works

Every eligible purchase earns a set percentage back, such as:

- 1%–2% on general purchases

- 3%–6% on business categories like office supplies, gas, or telecom

- Bonus cash back during promotional periods

Cash back can typically be redeemed as:

- Statement credits

- Bank account deposits

- Account balance reductions

The simplicity of cash back makes these cards appealing to many business owners.

Why Business Owners Use Cash Back Cards

1. Reduce Operating Costs

Cash back rewards essentially lower effective business expenses. When used strategically, they can offset costs for:

- Office supplies

- Travel expenses

- Marketing

- Technology subscriptions

2. Improve Cash Flow Management

Rewards are earned on expenses your business was already planning to make. This can provide a small but ongoing return throughout the year.

3. Separate Business and Personal Expenses

Using a business credit card helps keep finances organized, which is especially valuable for accounting and tax purposes.

4. Build Business Credit

Responsible use of a business credit card can contribute to building a stronger business credit profile—which may help with future financing.

Common Cash Back Categories for Business Cards

Cash back rates often vary by category. Typical categories include:

- Office Supplies and Equipment: Many business cards offer higher cash back for office-related purchases.

- Telecom Services: Phone, internet, and communication expenses are frequent business costs.

- Travel and Gas: Useful for businesses with mobile teams or frequent travel.

- Advertising and Marketing: Digital advertising platforms may qualify for higher rewards.

- General Purchases: Lower base cash back rate applied to all other business spending.

Understanding where your business spends most can help you choose the most rewarding card.

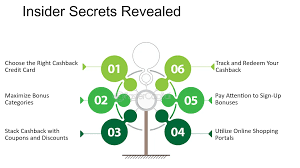

Sign-Up Bonuses: Business Rewards Kickstart

Many business cash back cards offer significant sign-up bonuses, such as:

- $300–$1,000 cash back

- After meeting a minimum spending threshold in the first 3–4 months

These bonuses can significantly accelerate reward earnings—especially for new cardholders launching or expanding operations.

Important: Only pursue a bonus if the spending requirement aligns with your planned business expenses.

Annual Fees: Worth It or Not?

Some cash back business cards come with annual fees. Whether a fee makes sense depends on:

When a Fee Is Worth It

- The card offers high cash back rates

- Valuable business perks are included (e.g., expense management tools, employee cards)

- Sign-up bonus outweighs the fee in the first year

When to Avoid a Fee

- Your business spending is low

- Cash back rates are modest

- You prefer a no-fee, simple rewards structure

Calculate your expected rewards versus cost before committing.

How to Maximize Cash Back Rewards

1. Use the Card for Everyday Business Expenses

The more you spend on categories that earn high cash back, the more rewards you accumulate.

2. Avoid Carrying a Balance

Interest charges can outweigh rewards quickly. Paying in full each month is essential.

3. Track Category Caps

Some cards increase cash back for bonus categories only up to a spending limit. Know these limits to plan strategy.

4. Combine Cards If Needed

Different cards may reward different categories. Some businesses use more than one card to capture maximum rewards—just manage payments carefully.

Cash Back vs. Points and Miles: What’s Best for Your Business?

Cash back is straightforward and flexible, but points or travel miles may offer higher value for some companies. Consider:

- Cash Flow Needs: Cash back directly affects your bottom line.

- Travel Frequency: If your business travels often, miles and travel rewards may outweigh cash back.

- Simplicity Preference: Cash back is easy to understand and redeem.

Your business goals should guide your choice.

Business Credit Requirements

Business card approval often considers:

- Business revenue

- Years in operation

- Owner credit score

- Existing debt

Some cards are easier to qualify for than others, especially for newer or smaller businesses.

Employee Cards: One More Advantage

Many cash back business cards offer no-additional-fee employee cards. Assigning cards to employees for approved business spending can help your business:

- Track expenses by department or project

- Earn more rewards faster

- Centralize billing

However, good controls and oversight are essential to prevent misuse.

Monitoring and Redeeming Your Cash Back

Business cash back rewards are typically redeemable in several ways:

- Statement credits (reduces balance)

- Direct deposit

- Checks

- Gift cards (less common)

Choose redemption methods that align with your financial needs—statement credits often deliver the most flexibility.

Common Mistakes Business Owners Make

1. Racking Up Debt for Rewards

Rewards are a bonus—not a reason to overspend.

2. Ignoring Fees and Interest

High interest can erase reward value. Always pay in full.

3. Misunderstanding Program Rules

Rewards programs often have specific category definitions and caps. Read the fine print.

4. Using Business Cards for Personal Spending

This risks mixing finances and complicates accounting.

Final Thoughts

Cash back business credit cards can be powerful tools when used responsibly. They offer meaningful returns on everyday expenses, improved cash flow management, and organizational clarity. But they are not magic money machines.

The key to success lies in understanding your business spending, choosing the right card(s), and managing payments responsibly. When aligned with a thoughtful financial strategy, cash back rewards can reduce costs and support your business goals year after year.

Reward smart spending—don’t let rewards drive your spending.

Word Count:

615

Summary:

A typical small business needs to watch every penny. To last in the competitive business world, you need to maximize profits and just as importantly, reduce expenses. Many businesses don�t realize that they could easily be saving a percentage of their purchases with a cash back business credit card. Instead of letting bank fees eat away at your profits, your credit card can work for you.

Keywords:

cash,back,business,credit,card,finance,small,best,rebate,new,compare,choose,choosing,credit card,cards,application

Article Body:

A typical small business needs to watch every penny. To last in the competitive business world, you need to maximize profits and just as importantly, reduce expenses. Many businesses don�t realize that they could easily be saving a percentage of their purchases with a cash back business credit card. Instead of letting bank fees eat away at your profits, your credit card can work for you.

How can the banks offer cash back for your business?

For decades the banks have been charging high interest rates and eating away at business profits. Businesses would just sit back, hoping the bank would eventually give them a better interest rate. Times are changing though. Today the credit card market is very competitive. A business can now choose between credit cards from nearly any financial institution.

As the banks compete, they are offering credit cards with better perks and rewards. If your business needs to travel a lot, you can get airline points. For a business that drives a lot, there are gas station rebate credit cards. Many larger stores even issue their own credit cards with special in store rebates. These credit cards lacked flexibility though. So as competition in the credit card market increased, credit card issuers resorted to offering cash back credit cards.

The banks can afford this to attain a new customer. The cash back is balanced out by interest charges and other fees. So for most people the cash back is just a savings on their bank fees. Plus these same customers might require additional financial services. The banks definitely aren�t losing much money by offering cash back.

Are cash back business credit cards just a scam?

No they are not a scam. These credit cards actually do give your business money back. You just need to be familiar with any restrictions. Most cash back business credit cards have a maximum annual cash back limit. Other cards have different cash back terms based on the credit card purchase type. For example, you might get a different cash back percentage at a gas station compared to a grocery store or office supply store. Some cash back credit cards also have a minimum spending before points can be redeemed.

To get the most out of a cash back credit card, you need to be disciplined. It is very tempting to put extra purchases on your credit card to get more cash back. Only use this strategy if you are able to pay off the card every month. Otherwise you would just be accumulating more interest charges. If you can pay the card off every month, try to use your credit card more instead of cash or checks.

For some businesses the cash back maximum can also be a problem. A business with high operating expenses could easily reach the annual cash back limit in a very short time. If this is the case, consider getting a different credit card to use once the limit has been reached. Some newer cash back business credit cards offer no limit on the amount of cash back you can earn.

Before applying just read the terms and conditions of the credit card. Many cash back credit cards use phrases like �up to 5% cash back�. This usually means that you can only get that cash back percentage for just one type of purchase or there is some other catch.

Despite certain card restrictions, a cash back credit card is a very good idea for your business. Your business could be saving thousands of dollars on your business expenses. Just take the time to compare different cash back business credit card offers before you apply.

Leave a Reply